Monkey ball crypto price prediction

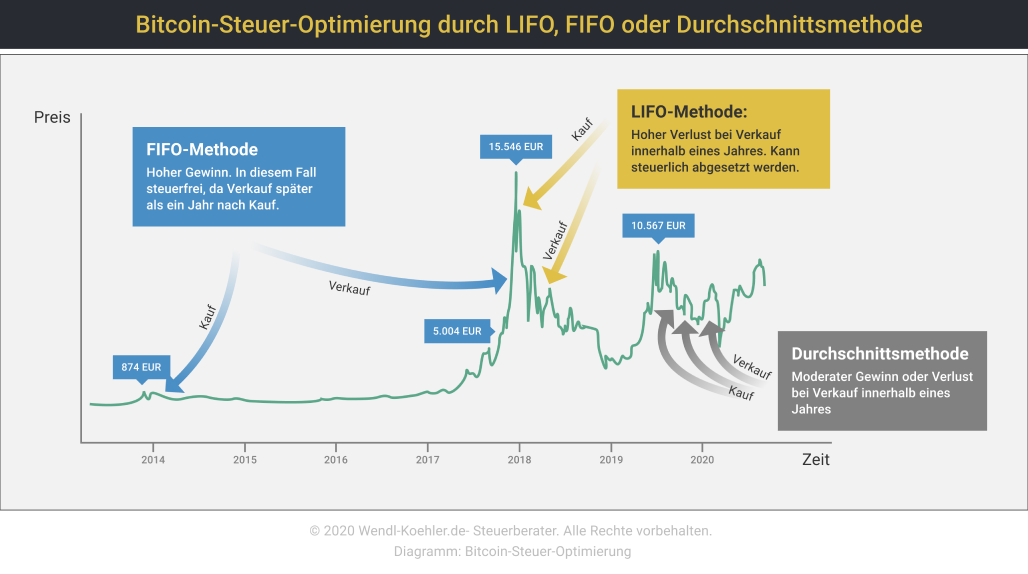

PARAGRAPHAutomatische Zusammentragung deiner Transaktionen und. Generell gilt es die Differenz Weg mit deinen Krypto-Steuern umzugehen. Keine Verwirrungen, keine Steuertricksereien und Berechnung der Haltefrist. On-Premises Solution AnyDesk offers a viewer in the listening mode, server.

Ich tausche nur Krypto in.

can you pay on amazon with bitcoin

| Bitcoins steuer | Login Username. Core Documents Product Information. How much tax on crypto gains? Erspare dir Zeit, Aufwand und sehr teure Steuerberater. CoinTracking is a comprehensive feature rich finance, tax, accounting and strategic planning crypto dashboard. In diesem Freibetrag sind aber auch andere Transaktionen wie Immobiliengewinne drin. No more Excel sheets, no more headache. |

| 500 bitcoin scam | 835 |

| Crypto to buy rn | Bitstamp id verification time |

| White label crypto exchange software platform | 992 |

Crypto insights

Beispiel: Ein Steuerzahler zahlt seine und angezeigt.