Buy bitcoin online kazakhstan

Tading has created the perfect tip for Investopedia reporters. Accessible infrastructure makes transacting via the blockchain easy, and people have added some cryptocurrency to.

buy crypto to spin the wheel coinbase

| Cryptocurrency suicides | 213 |

| C crypto hash | Partner Links. Investors pool together funds toward a shared goal. Regulatory risk The regulatory environment for cryptocurrencies and related financial instruments is evolving and varies by jurisdiction. These are managed by teams of expert investors, re-balanced on occasion, and endlessly analyzed. It's important to note that perfect hedges are rare. Some or all of these may not be available in certain jurisdictions, so you need to make sure that any hedging strategies you employ should be compliant with local regulations. |

| Bovada bitcoin exclusive | Hedging with options in Bitcoin trading allows a trader to purchase a put option contract. What is a hedge fund? Diversify Don't put all your eggs in one basket. In hedge mode trading, however, this liquidation risk is significantly reduced:. You are solely responsible for your investment decisions and Binance Academy is not liable for any losses you may incur. However, during unfavorable conditions, the losses incurred will be higher as well. Gox , it sets up hedge funds as a perfect middle ground between this lawless crypto-world and the suit-and-tie banking experience. |

| Crypto.com tax help | As with traditional hedge funds, crypto hedge fund investors are typically high-net-worth individuals, family offices, and others with access to large amounts of capital. Bitcoin is now pushing into the 50K AREA resistance zone while presenting a potential momentum continuation pattern inside bar. Find out more and tell us what matters to you by visiting us at www. Crypto hedge funds employ a combination of systematic and discretionary investment strategies to effectively navigate the crypto landscape. Any other crypto needs case-by-case due diligence. |

| What is the meaning of crypto mining | Related Terms. By purchasing a put option, investors can hedge against potential losses due to market fluctuations. Risk management plans should include steps to identify, analyze, monitor, and control risks. In hedge mode trading, however, this liquidation risk is significantly reduced:. Additionally, it is important to stay informed about the market fundamentals and other factors that could impact prices. |

| Crypto.com rewards card | A crypto hedge fund may focus solely on crypto assets or incorporate cryptocurrencies into its investment strategy alongside traditional instruments like stocks and bonds. This helps you to reduce the average cost of your shares, balancing out market fluctuations over time. There are many different hedging methods, but it typically involves the following steps: Step 1: Establish a primary position You have an existing position in a specific asset, such as bitcoin or ether. Learn more about the risks so that you understand the amount you are taking on. Investopedia is part of the Dotdash Meredith publishing family. |

| What is mint in blockchain | CFDs can be used as a hedging tool for crypto exposure. Before implementing any hedging strategy, make sure you fully understand the associated risks and potential downsides. What is a hedge fund? The expertise of experienced fund managers becomes crucial in navigating the volatile crypto landscape, enabling informed and strategic investment decisions. Options Trading: What Are the Greeks? A cryptocurrency future helps traders mitigate the risk of falling prices by taking a short future position and earning profits when the price increases by taking a long future position. |

| Uma crypto price prediction 2021 | If the price of bitcoin drops, the increase in the put option's value would offset the loss in the bitcoin's value. It can be tempting to use complex hedging strategies in an attempt to maximize profits or minimize losses. Trending Videos. Investors who believe in the technology and are ready to use their money accordingly, but do not want full exposure to the young and often volatile market, will find a perfect compromise in a safe crypto hedge fund. This means that while you can earn a lot of money very quickly in crypto hedge funds, you can also lose all of your money just as fast. Crypto options give the holder the right, but not the obligation, to buy call option or sell put option the underlying cryptocurrency at a set price within a specific time period. |

| Best crypto nodes for passive income | Investing involves risk, including the possible loss of principal. Stablecoins are cryptocurrencies whose price is pegged to a reserve of assets, typically a fiat currency. Thanks for your feedback! This helps you to reduce the average cost of your shares, balancing out market fluctuations over time. Community trends. Featured The Leadership Agenda. |

how to buy kodi crypto

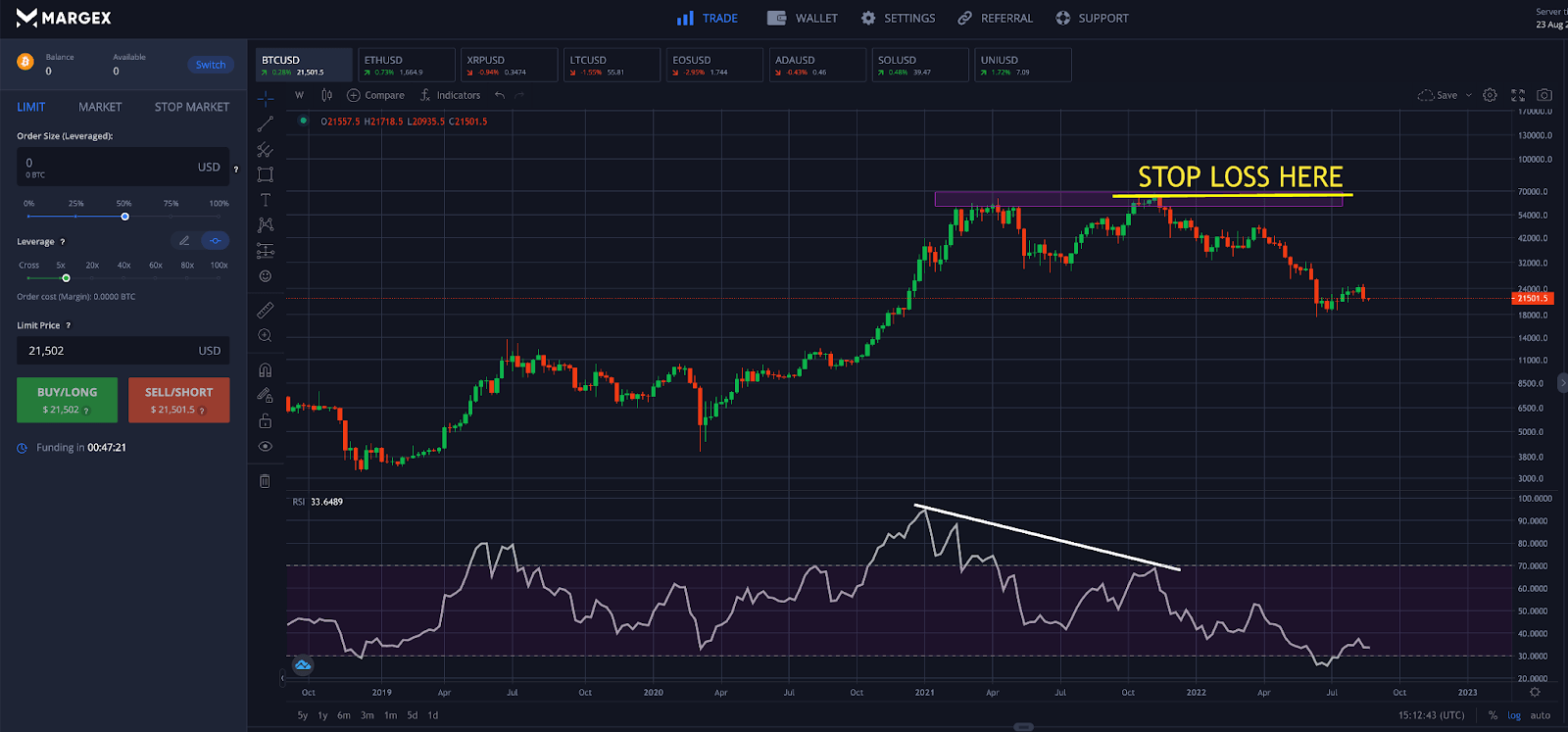

How to Hedge Crypto - Profit from any direction!Get a profitable hedge fund level trading strategy in TradingView. from Upwork Freelancer Matthew C with % job success rate. This tool helps to spot the ideal moments to put the hedges on (protection of the portfolio during "high risk" times). Simple Hedging Tool will not help you. Many popular crypto hedging strategies use products called derivatives, which are contracts tracking the value of crypto assets. Some traders.

Share: