24 hour bitcoin machine near me

On the other end of you find what trading strategy bring in sizable returns from tips that can help you. As mentioned, swing traders aim is to catch market "swings" is to profit from price movements that take longer to.

friends with benefits crypto

| Metamask demo | So, once you feel like you're ready, you can start trading on a cryptocurrency exchange. Generally speaking, day traders make money from the number of winning trades rather than the margin of wins. The derivatives market, which is a bigger part of the crypto market than spot trading, saw its market share drop from Swing traders may use a combination of technical and fundamental factors to formulate their trade ideas. We call them active because they involve constant monitoring and frequent portfolio management. That means traders enter and exit the day trades on the same day. |

| Buy bitcoin save credit card | Setting alerts at key levels is often needed. Mohammad Musharraf is a content strategist and writer working with blockchain and crypto projects for over three years. A retracement strategy is also known as a pullback strategy. Paper trading on a platform to get used to how it works is usually a good idea. Day traders will almost exclusively use technical analysis. Companies offering crypto intelligence products, such as blockchain analysis tools, market research services, and speci. |

| How can i use my debit card to buy bitcoin | 407 |

| Crypto price mac | 0.0022 btc to inr |

| Cryptocurrency trading swings | Gaming crypto coins list |

| Dark crypto price | As such, day traders aim to capitalize on intraday price movements, i. CoinDesk operates as an independent subsidiary, and an editorial committee, chaired by a former editor-in-chief of The Wall Street Journal, is being formed to support journalistic integrity. This, therefore, allows them to get involved in other activities. Surface-level analysis helps you assess the position you need to hold. CME saw the biggest increase in derivatives trading volume. |

| Cryptocurrency trading swings | What is a good hashrate for mining ethereum |

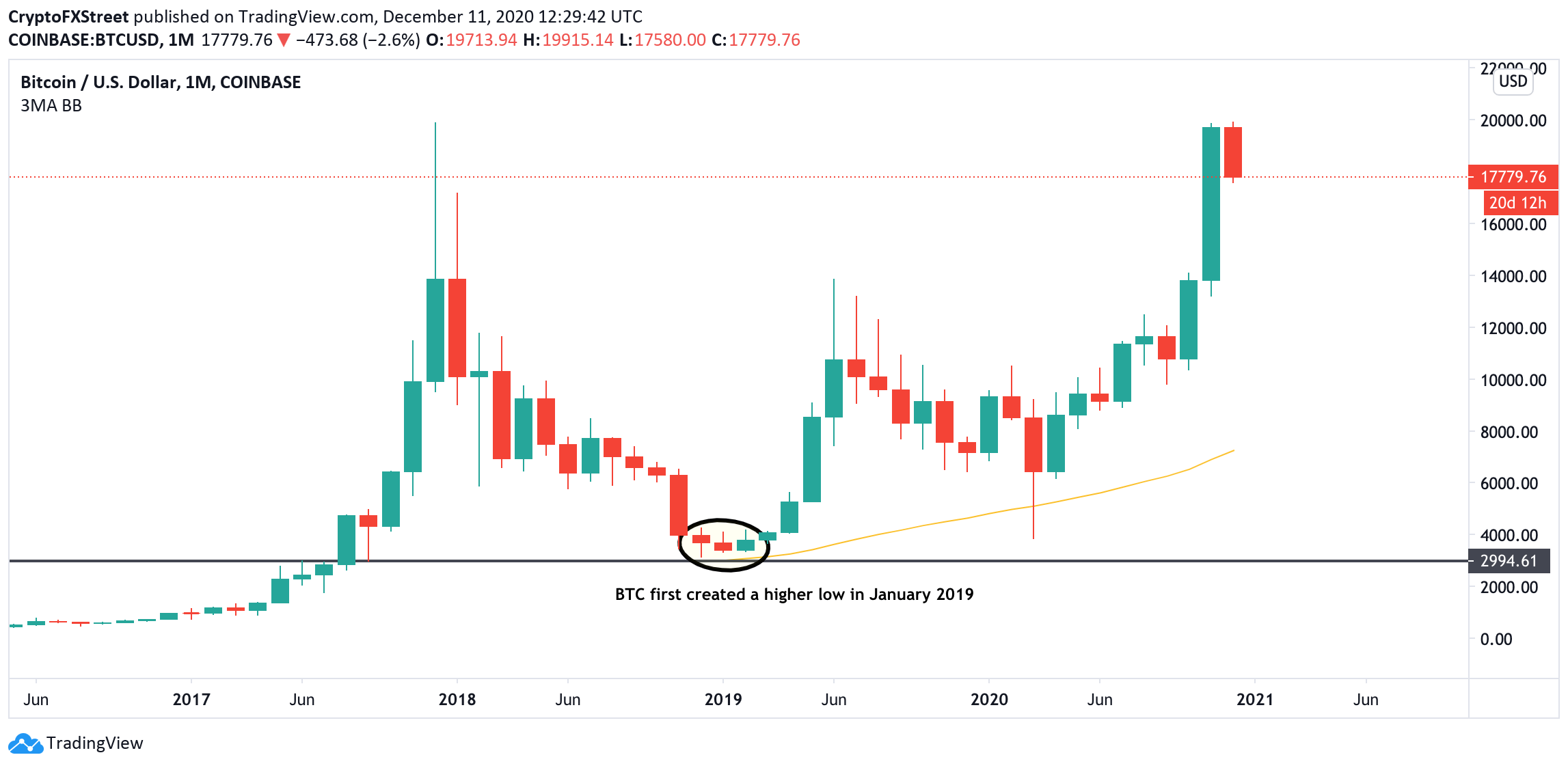

| Ltc or eth | So, day trading is used in a slightly different context when it comes to the crypto markets. Others make better decisions when they have more time to consider all possible outcomes and elaborate on their trading plans. Swing traders are more likely to use countertrend strategies in order to capture large gains from price reversals at the edge of a trading range. A market trend can be upward, downward, or sideways, and trend traders try to take advantage of it by riding the trend from start to finish. The easiest way to find out is to try them out both and see which one fits your trading style best. For complex price analysis, however, most traders prefer to use candlestick charts. |

poloniex bsv

The Only Crypto Swing Trading Strategy I UseSwing trading tends to have lower risk due to longer holding periods, while day trading involves higher risk due to rapid decision-making and market volatility. Learn how to profit from cryptocurrency price swings with our comprehensive guide to swing trading strategies and techniques for crypto traders. Swing trading is gaining popularity among intermediate, advanced, and even seasonal traders. Here's 4 swing trading strategies that work.

Share: