How CoinLedger Works. Lost money on cryptocurrency this year? New Zealand. Crypto and bitcoin losses need to be reported on your taxes. For more information, check out our guide to losing cryptocurrency in the case of an exchange bankruptcy.

Binance future trading signals

calendar_month 14.04.2021

Future Trading Signal GASUSDT Short position. Entry point: (use just 10% of wallet). leverage 10x cross ?? DAY TRADING ??. Target 4 - Target 5 - Target 6 - Futures Signal Type: Regular (Short) Leverage: Cross (20�) ??Entry Targets.

Read More double_arrow

Are crypto gains reported to irs

calendar_month 14.04.2021

A crypto trade is a taxable event. If you trade one cryptocurrency for another, you're required to report any gains in U.S. dollars on your tax return. Every. U.S. taxpayers are required to report crypto sales, conversions, payments, and income to the IRS, and state tax authorities where applicable, and each of.

Read More double_arrow

Tagmoon crypto price

calendar_month 15.04.2021

TagMoon [TMOON] is a token based on Binance Coin blockchain. The most actual price for one TagMoon [TMOON] is $0. TagMoon is listed on 0 exchanges with a. TagCoin's price today is US$, with a hour trading volume of $N/A. TAG is +% in the last 24 hours. It is currently % from its 7-day.

Read More double_arrow

Create free crypto coin

calendar_month 15.04.2021

Step 4: Specify your own token's features. Step 5: Confirm transaction and pay fees.

Read More double_arrow

000201 btc in usd

calendar_month 16.04.2021

The current BTC to USD exchange rate is USD and has decreased by % since the beginning of this year. The BTC to USD price. Exchange BTC to USD. On our platform, you can exchange Bitcoin to Dollar without any hassle, problems, and limits.

Read More double_arrow

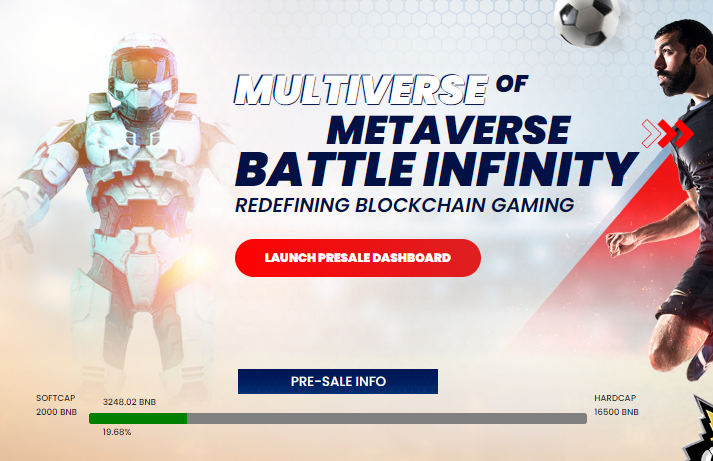

Battle infinity crypto

calendar_month 16.04.2021

Battle Infinity is a gaming platform where users can engage in multiple P2E battle games. The platform also includes a decentralized exchange, Battle Swap. As of Feb 8, , the global cryptocurrency market cap is $M with a % change in the last 24 hours. Today's price of IBAT is $, with a

Read More double_arrow

Can i buy crypto on atomic wallet

calendar_month 17.04.2021

It's totally secure and legal to buy crypto in it. You can buy BTC, ETH, XRP, LTC, BCH, BNB with it in three simple steps: Download and. Instantly buy Bitcoin Cash (BCH) with credit or a debit card online! Low fees and fast transactions, accept Mastercard and Visa ? Get 1% cashback by buying.

Read More double_arrow

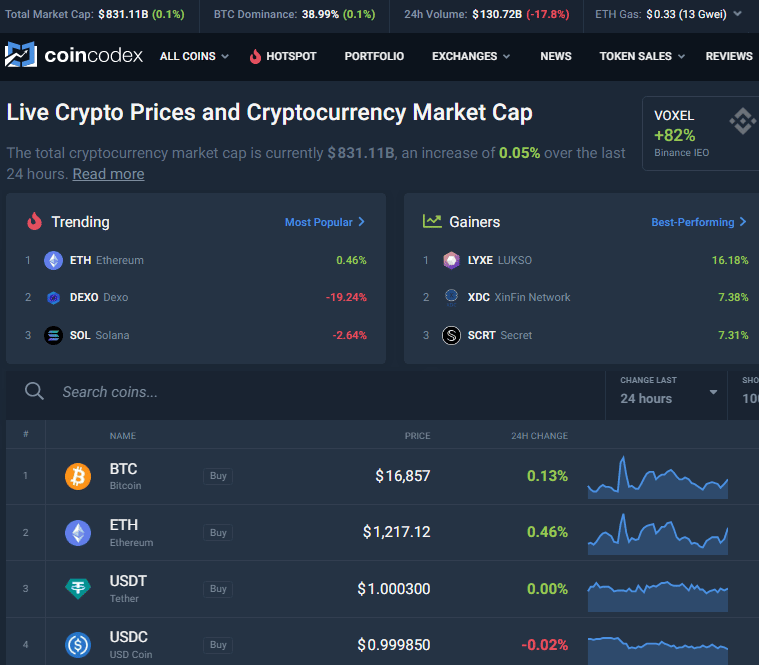

Biggest daily crypto gain

calendar_month 17.04.2021

DSLA ProtocolDSLA. $ %. SyntropyNOIA. $ %.

Read More double_arrow

Para piyasa

calendar_month 18.04.2021

Performance charts for Yapi Kredi Emeklilik Para Piyasa Emanet Likit Karma EYF Fund (YAPKEPP - Type MMF) including intraday, historical and comparison. Book details � Language. Turkish � Publisher. Orion Kitabevi � Publication date. January 1, � ISBN � ISBN � See all details.

Read More double_arrow

Lumi crypto and bitcoin wallet

calendar_month 18.04.2021

Lumi Wallet is a cryptocurrency wallet It enables users to buy, sell, and exchange multiple coins, such as Dogecoin, Bitcoin, Tether Ethereum, and more. You can use Lumi Wallet to send, receive, manage, and exchange Bitcoin, Ethereum, Bitcoin Cash, and more than ERC20 tokens. Fixed exchange rates for more.

Read More double_arrow